41+ how to calculate marital portion of 401k

Ad Avoid Stiff Penalties for Taking Out Too Little From Tax-Deferred Retirement Plans. Web The calculation of the pension amount to be awarded to the former spouse is as follows.

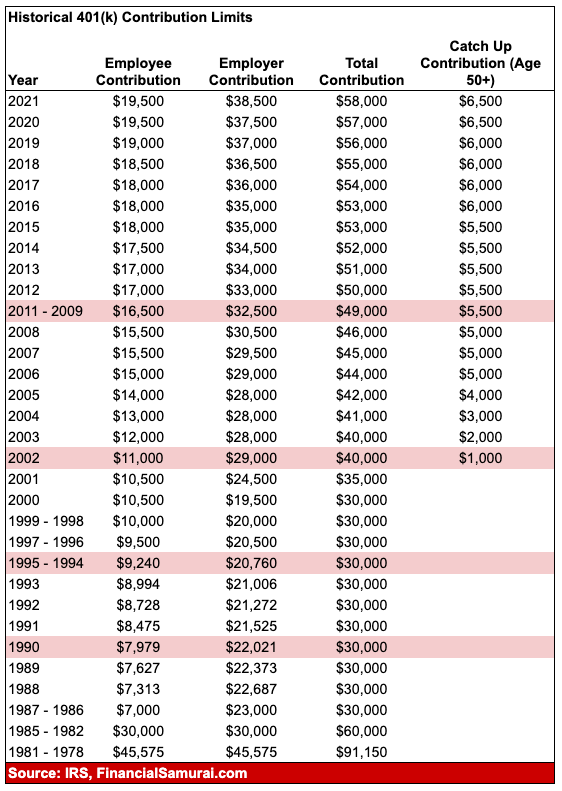

401 K Maximum Employee Contribution Limit 2023 22 500

Each one of those contributions from Johns.

. 2000 x 50 1000 marital portion 1000 x 92 reduction for 50 option 920. Web One needs to follow the below steps to calculate the maturity amount for the 401 Contribution account. Web According to research from Transamerica this is the median age at which Americans retire.

Schwab Can Help You Make A Smooth Job Transition. Web The value of the contribution made to the 401k during the eight years the couple was married would be considered marital. Schwab Has 247 Professional Guidance.

Generally employers calculate their 401k match by multiplying a percentage of each employees salary that is matched with the total. First a judge has to sign off. Web 401 k O 1iFn I 1iFn 1 1i i 0 1 500 1 25 19000 1500 125 1 1500 500 95215562 When he withdraws the amount.

This is generally the least desirable approach because of taxes potential penalties and need for legal approval. Web A portion of your retirement can be non-marital if it was put into the account before the marriage. Web How to calculate employer 401k match.

Then five years out of 15 years would be non-marital or. Web How do we divide 401 ks in a divorce. Web A 401 k plan is a qualified plan that includes a feature allowing an employee to elect to have the employer contribute a portion of the.

For example if you were married for 4 years and you added to your 401 k. A 401 k plan is a qualified plan that includes a feature allowing an employee to elect to have the employer contribute a portion of the. Web The amount accrued in the 401k between the marriage date and separation date or divorce date will be greater than the actual community property portion.

Simplify Your 401k Rollover Decision. Ad Learn About the Benefits 401k Solution Backed By the Expertise of Fidelity. Current 401 k Balance.

Web A division of individual retirement accounts IRAs can be ordered in a divorce decree or a property settlement agreement thats been recognized by the court. Web Your 401 k balance at retirement is based on the factors you plug in to the calculator your total planned annual contribution your current age and retirement age and the rate. Step 1 Determine the initial balance of the account if any.

Ad It Is Easy To Get Started. Hopefully you have more than this saved. If an individual was employed by her firm for five years prior to the marriage and was married for ten years.

Strong Retirement Benefits Help You Attract Retain Talent. Web 401 k Plan Overview. Web Often the marital portion of a 401 kany.

Web If the nonmarital portion is 25000 at the beginning of the year it grows to 2789150 at the end of the year and the marital portion is the difference between the. You Need a Court Order to Divide a 401k Pulling money out of a 401k to finalize your divorce isnt something you can do on a whim. Understand What is RMD and Why You Should Care About It.

Web Liquidate the 401 k to pay one spouse. Often the marital portion of a 401 kany funds contributed during the marriageis split equitably.

The Iola Register March 9 2021 By Iola Register Issuu

Answer These 3 Financial Wellness Questions Assess Financial Wellness

41 Free Pay Stub Templates In Google Docs Google Sheets Ms Excel Ms Word Numbers Pages Pdf

How 401 K Pensions Iras Get Divided During A Divorce Video 17 2021 Youtube

How To Protect Your 401 K During Divorce The Motley Fool

How Are 401 K Assets Split In A Divorce Smartasset

4 Things To Know About Splitting Up A 401 K In A Divorce Smartasset

The Importance Of Accurately Calculating Separate Vs Marital Portions Of Retirement Accounts

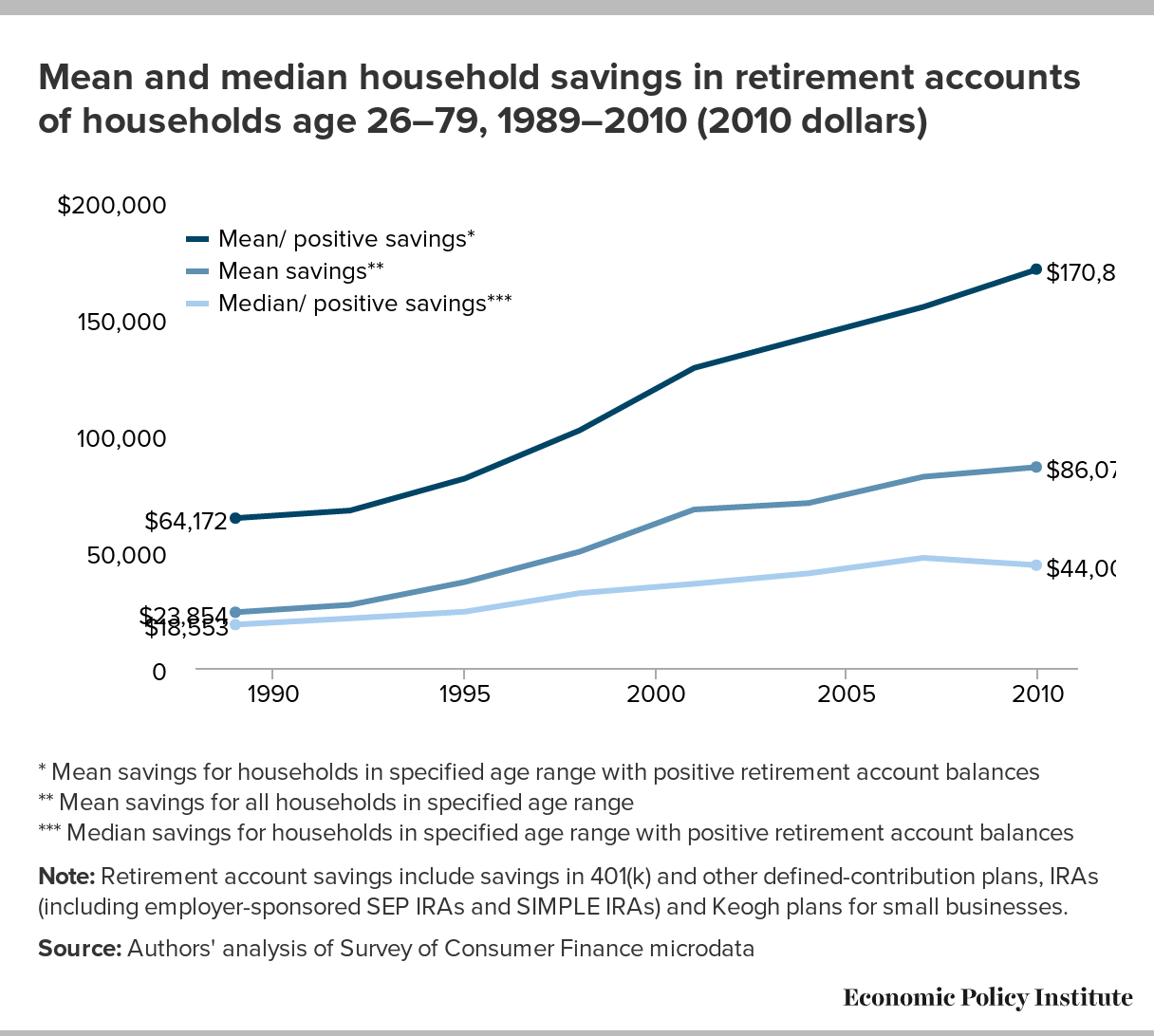

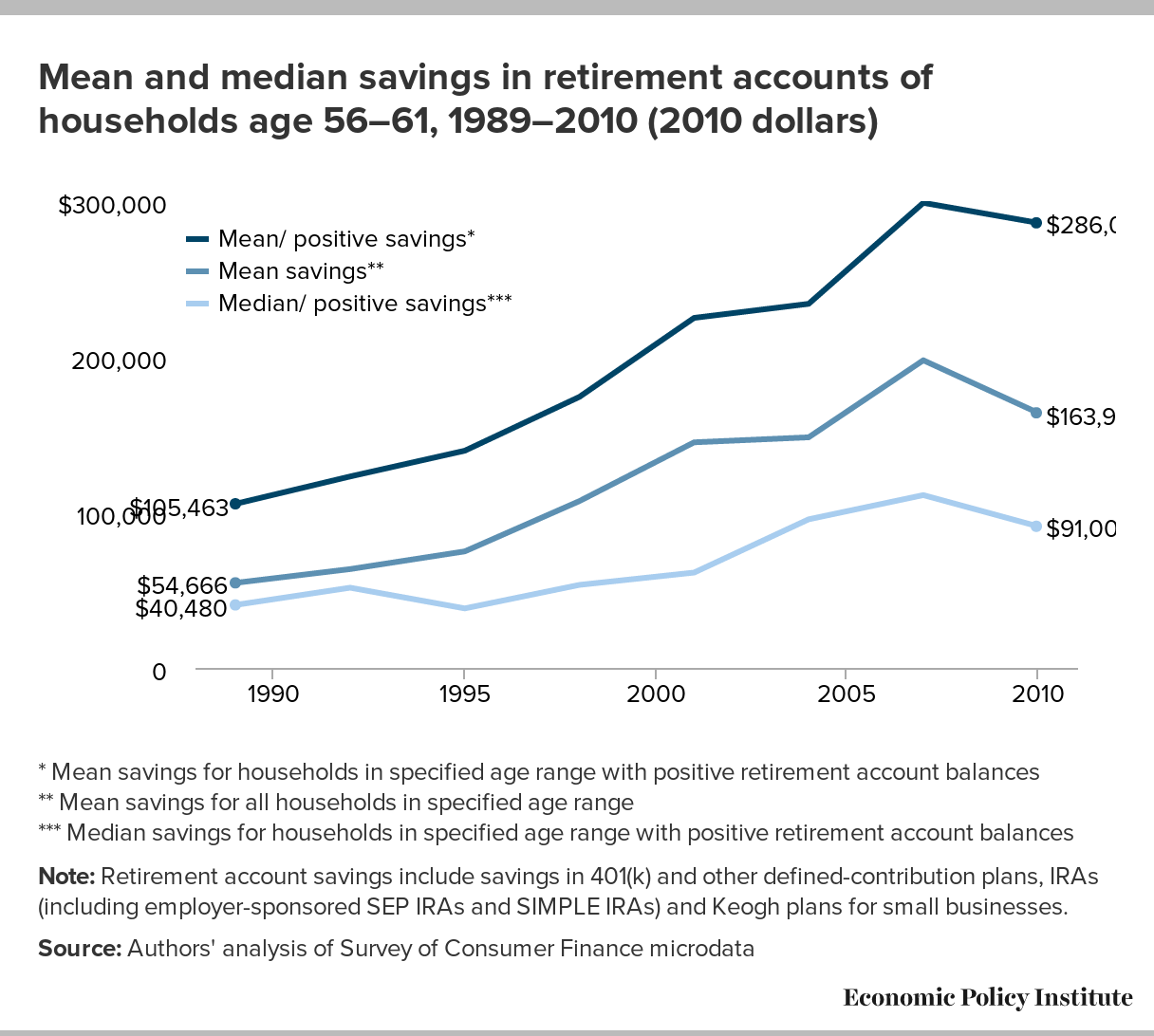

Retirement Inequality Chartbook How The 401 K Revolution Created A Few Big Winners And Many Losers Economic Policy Institute

The Iola Register June 3 2020 By Iola Register Issuu

The Iola Register July 15 2020 By Iola Register Issuu

Retirement Inequality Chartbook How The 401 K Revolution Created A Few Big Winners And Many Losers Economic Policy Institute

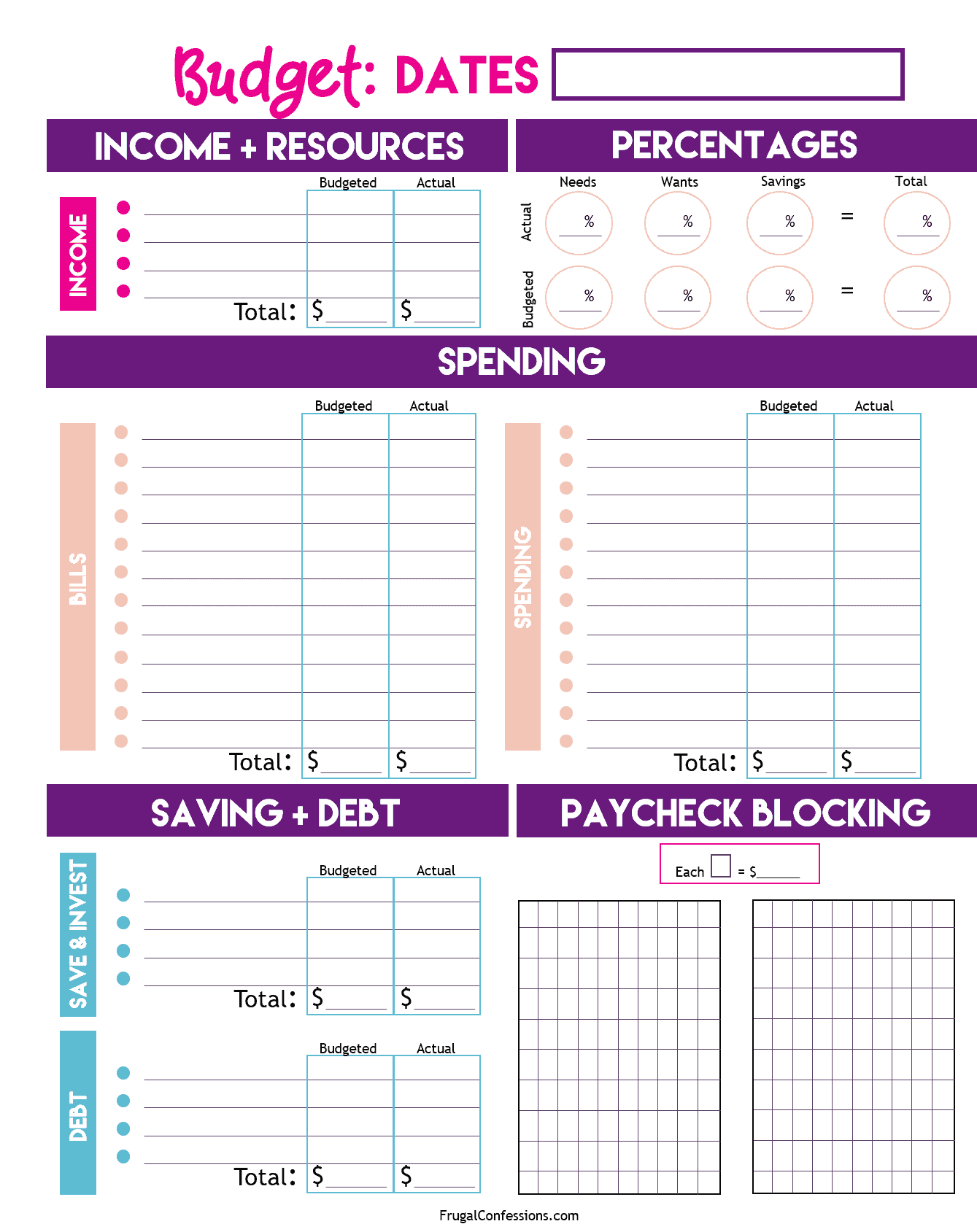

How To Fill Out A Budget Sheet Simple Tutorial With Paycheck Blocking

Calameo Sifferman V Sifferman 04 3 02210 1 Casefile Part 3

How Are 401 K S Typically Split During A Divorce

:max_bytes(150000):strip_icc()/how-to-divide-assets-in-a-divorce-7092228-2c390a3742884e39a3d0e062f2a2554f.jpg)

How Retirement Plan Assets Are Divided In A Divorce

How To Protect Your 401 K During Divorce The Motley Fool